What are three different types of fees that a credit card company can charge you?

8 common credit card fees and how to avoid them

- Annual fee. Many credit cards charge a fee every year just for having the card.

- Interest charges.

- Late payment fee.

- Foreign transaction fee.

- Balance transfer fee.

- Cash advance fee.

- Over-the-limit fee.

- Returned payment fee. Table of Contents

What are the fees credit card companies can charge?

Credit Card Processing Fees and Costs

Network Average Credit Card Processing Fees MasterCard 1.55% – 2.6% Visa 1.43% – 2.4% Discover 1.56% – 2.3% American Express 2.5% – 3.5% How are credit merchant fees calculated?

The first step of calculating your credit card processing fees is finding your effective rate. First, you’ll need to pull out your credit card statement. Next, you’ll need to take the total amount deducted for processing and divide it by the amount of your total monthly sales that paid using credit cards.

Do credit cards have interchange fees?

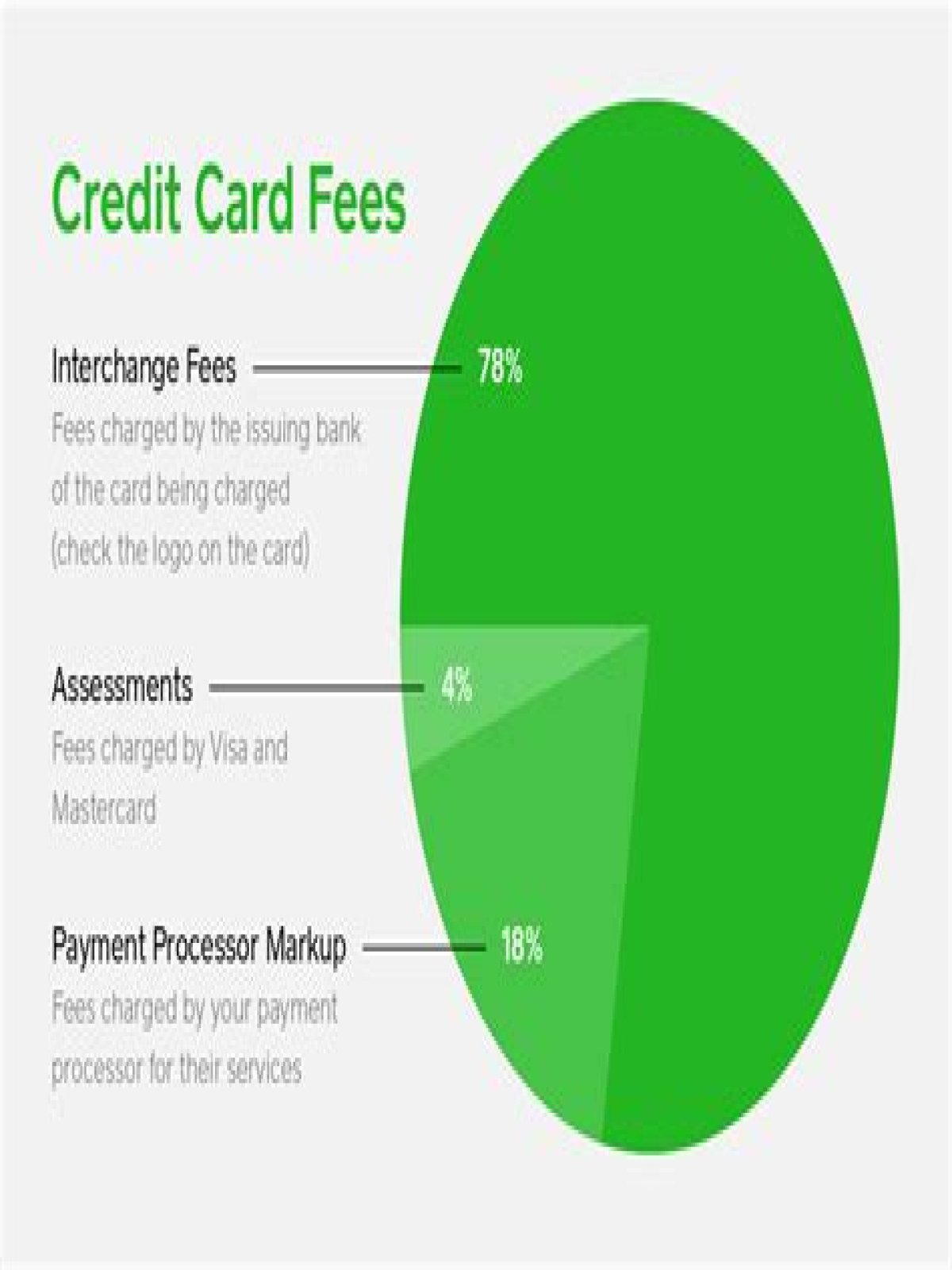

Interchange fees are charged to merchants by card networks for processing a debit or credit payment. These fees make up a majority of the cost involved in accepting a card payment. Though interchange fees are collected by the card networks, they are paid out to the bank that issued the payment card.

How do I stop credit card processing fees?

Seven Ways To Lower Credit Card Processing Fees

- Apply A Surcharge. The easiest way to avoid paying credit card processing fees is by passing them on to your customer.

- Capture More Customer Data.

- Swipe Whenever Possible.

- Offer ACH Payments.

- Become PCI Compliant.

- Check Your Statements.

- Ask Your Processor.

How do you avoid interchange fees?

Interchange fees and penalties: the basics

- 1: Use an Address Verification Service for credit cards.

- 2: Settle transactions quickly.

- 3: Send customer service info for transactions.

- 4: Include transaction-specific data.

- 5: Don’t enter credit card details manually.

Why do credit card companies charge different fees?

That’s because the credit card company, issuer and processor all get a chunk of the total per-transaction fee and each of those companies charges a different rate per transaction. Additionally, retailers pay different rates based on how the card is processed. Assessment Fees, but the percentage changes by the company with regularity.

Do you have to pay a credit card processing fee?

Even so, some credit card processing companies charge a flat rate per transaction, but others charge a percentage in addition to the interchange cost. Your average fees are also affected by the types of payments you usually accept. In-person payments like a swipe or a dip are usually the lowest cost.

Can a merchant charge a convenience fee for using a credit card?

Merchants are allowed to charge customers a convenience fee for using a credit card if the customer is using an alternative payment channel. For example, if a company usually accepts payments in person, a convenience fee might be added if their customer uses a telephone or order online.

Do you have to pay credit card surcharges?

States may also have specific laws governing extra fees, so you should be sure your fees comply with state laws before assessing them to your customers. Surcharges are another regulated type of credit card fee. Surcharges are simply fees assessed to any customer who uses a credit card.