What are fiduciary fees on Form 1041?

When preparing an estate or trust’s income tax Form 1041, you may deduct fiduciary fees. Fiduciary fees are the amounts executors, administrators, or trustees charge for their services.

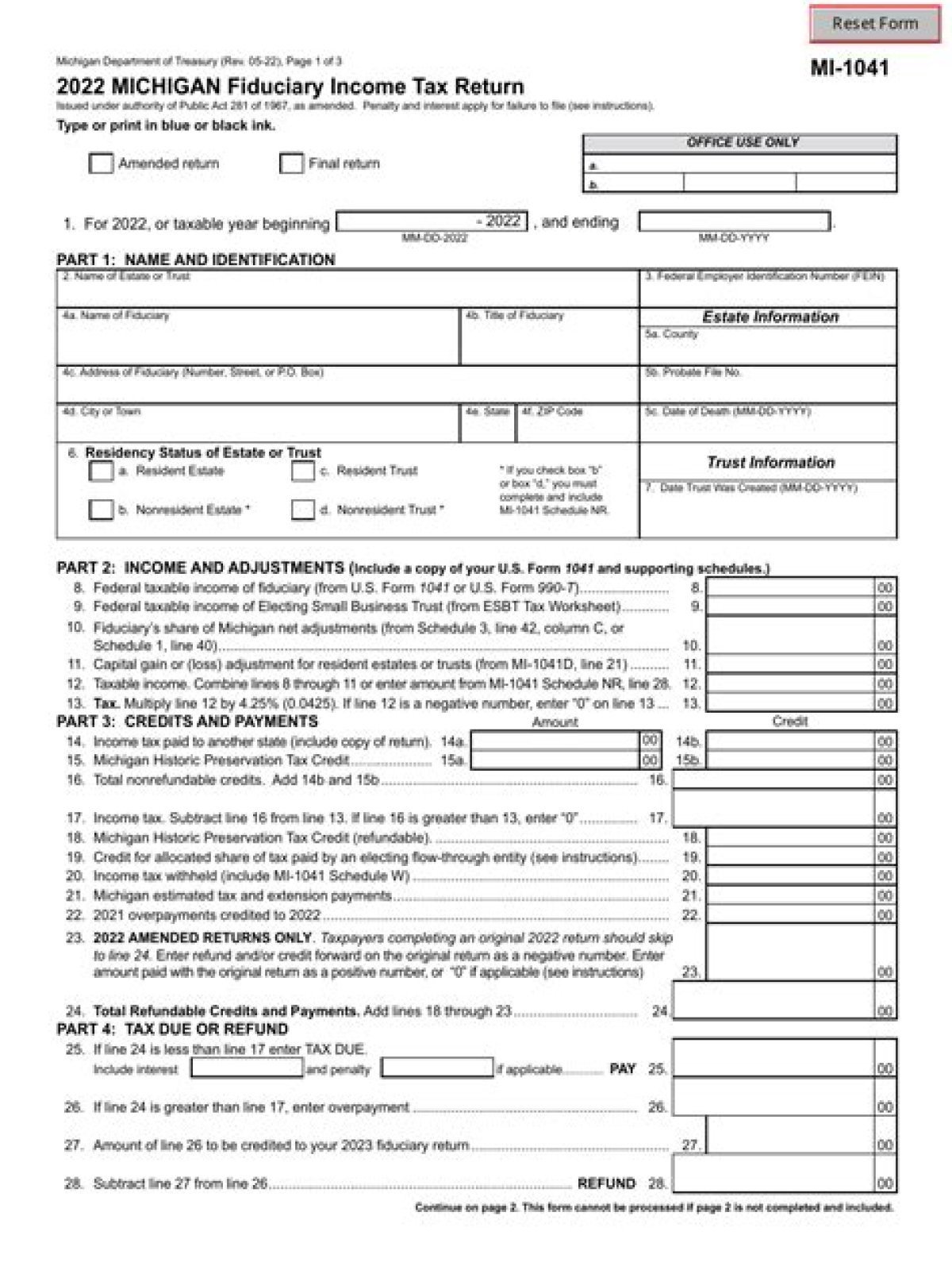

Who needs to fill out a 1041?

IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, is required if the estate generates more than $600 in annual gross income. The decedent and their estate are separate taxable entities.

How much does it cost to prepare a 1041?

The average cost for preparing a 1041 Tax Form (fiduciary) is $497. The average cost for preparing a 990 Tax Form (tax-exempt organization) is $667.

What is a reasonable fiduciary fee?

Most corporate Trustees will receive between 1% to 2%of the Trust assets. For example, a Trust that is valued at $10 million, will pay $100,000 to $200,000 annually as Trustee fees. This is routine in the industry and accepted practice in the view of most California courts.

How are fiduciary fees deducted on a 1041?

Form 1041 Instructions, Pages 24-25. Line 12—Fiduciary Fees Enter the deductible fees paid or incurred to the fiduciary for administering the estate or trust during the tax year. Fiduciary expenses include probate court fees and costs, fiduciary bond premiums, legal publication costs of notices to creditors or heirs, the cost of

How do you calculate fiduciary fees on a tax return?

To calculate the allocation: Subtotal the income shown on lines 1 through 8 of Form 1041 and add the tax-exempt income from line 1 in “Other Information” on the back of the return to arrive at total income. Divide the total income by the total taxable income and multiply the results by the total fiduciary fees.

What kind of income is required to file Form 1041?

Form 1041 E-filing. Adjusted gross income (AGI). Electing small business trust (ESBT). Beneficiary. Decedent’s estate. Distributable net income (DNI). Income in respect of a decedent. Deductions and credits in respect of a decedent. Income required to be distributed currently. Fiduciary.

Can you deduct fiduciary fees on an estate tax form?

When preparing an estate or trust’s income tax Form 1041, you may deduct fiduciary fees.