What date are property taxes due in California?

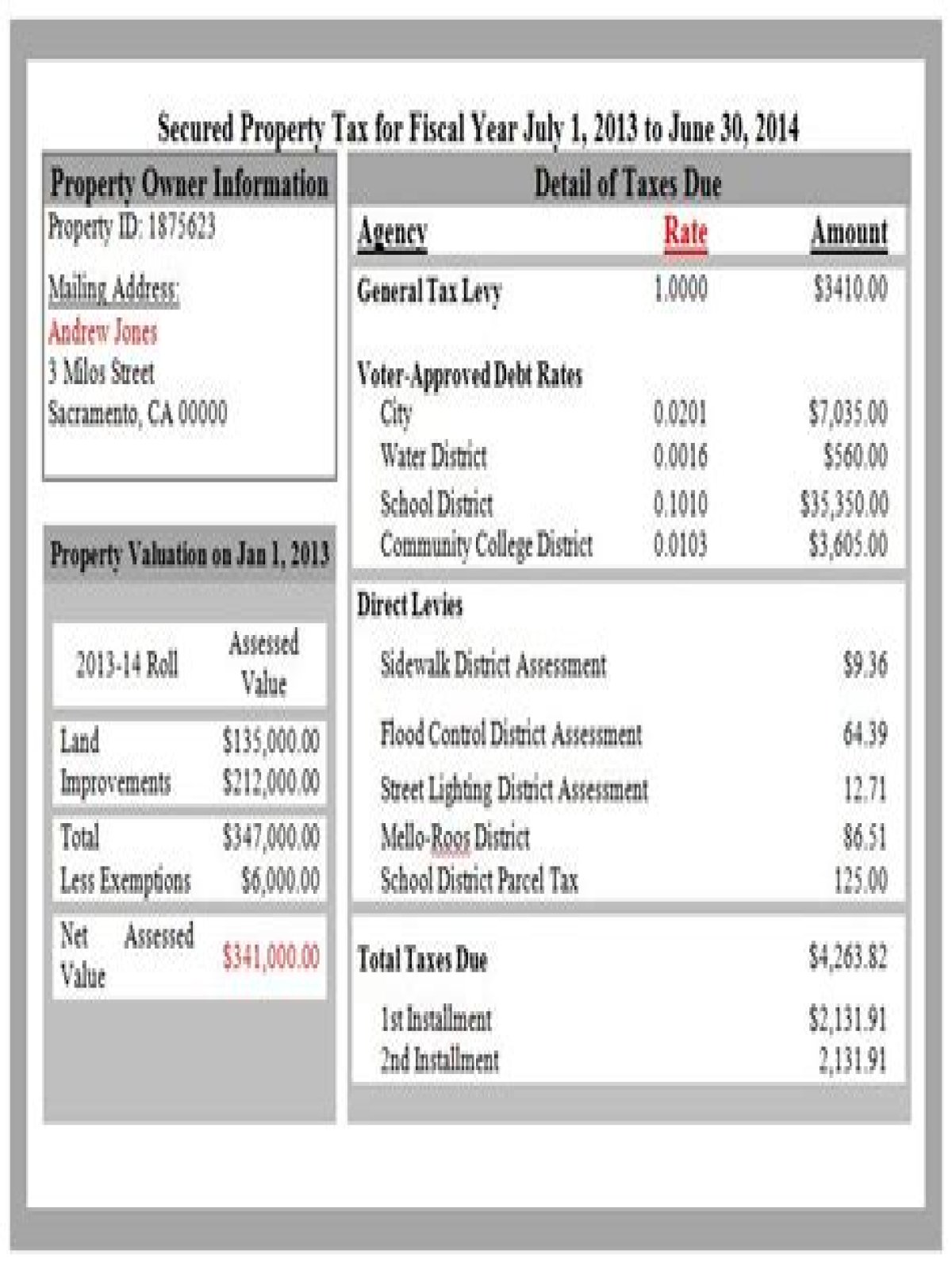

Remember: UNDER CALIFORNIA LAW, IT IS THE RESPONSIBILITY OF THE TAXPAYER TO OBTAIN ALL TAX BILL(S) AND TO MAKE TIMELY PAYMENT. For secured property taxes, the first installment is due November 1 and delinquent after December 10, and the second installment is due on February 1 and delinquent after April 10.

Does California have property tax breaks for seniors?

California doesn’t offer many special property tax breaks for seniors, although they can claim the standard California write-offs other homeowners are entitled to. For example, there’s a $7,000 deduction on the assessed value of a personal home, which lowers taxes about $70.

Do we still have to pay property taxes in California?

California property taxes are generally due in two installments, on December 10th, and April 10th, of each year. Property taxes in California are jointly administered by the Board of Equalization and the 58 county assessors.

Who is exempt from paying property taxes in California?

You may be eligible for property tax assistance if you are 62 years of age or older, blind or disabled, own and live in your own home, and meet certain household income limitations. For additional information regarding homeowner property tax assistance, contact the California Franchise Tax Board at 1-800-868-4171.

What kind of property is a property tax?

A property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

How often do you have to pay property tax?

How you pay your property taxes varies from place to place. Some people pay extra each month to their mortgage lender. The lender keeps that money in escrow and then pays the government on behalf of the homeowner. Other people pay their property tax bill directly to the county government on a monthly, quarterly, semi-annual or annual basis.

How to calculate property tax for your County?

In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice.

Are there any problems with paying property taxes?

However, property taxes pose several problems for the economy, homeowners and even the governments that gain revenue through charging property tax. One of the biggest problems with property taxes is the high level of administrative costs.