What is considered a financing activity?

In the cash flow statement, financing activities refer to the flow of cash between a business and its owners and creditors. It focuses on how the business raises capital and pays back its investors. The activities include issuing and selling stock, paying cash dividends and adding loans.

What is an example of financing activity?

Examples of common cash flow items stemming from a firm’s financing activities are: Receiving cash from issuing stock or spending cash to repurchase shares. Receiving cash from issuing debt or paying down debt. Paying cash dividends to shareholders.

Which is not a financing activity?

Sale of investment is not a financing activity.

What are the four major activities for finance?

Finance is defined as the management of money and includes activities such as investing, borrowing, lending, budgeting, saving, and forecasting. There are three main types of finance: (1) personal.

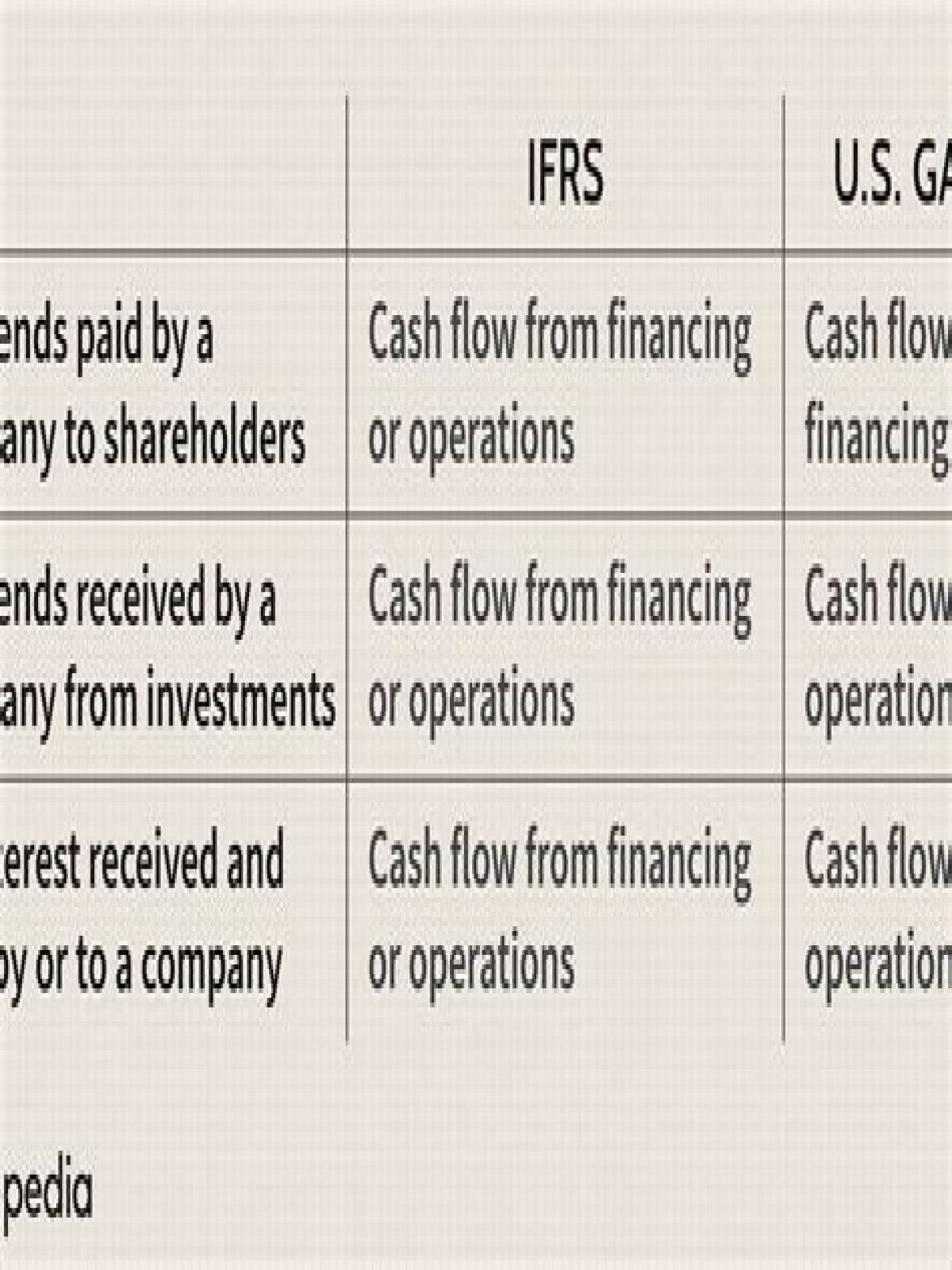

Is interest paid a financing activity?

Interest and dividends classified as operating activities. Dividends received are classified as operating activities. Dividends paid are classified as financing activities. Interest and dividends received or paid are classified in a consistent manner as either operating, investing or financing cash activities.

What are the 2 sources of finance?

The main sources of funding are retained earnings, debt capital, and equity capital. Companies use retained earnings from business operations to expand or distribute dividends to their shareholders. Businesses raise funds by borrowing debt privately from a bank or by going public (issuing debt securities).

How to calculate note receivable or investing activity financing activities?

Increase ( + ) … Collection of principal on note receivable … Cash flow from Financing activities Qaf Investingnote Note Payable Investing Activity investing activities and financing activities. total cash flow equals the total cash inflows minus the total cash outflows from each section. Cash

What does it mean to finance accounts receivable?

Accounts receivable financing allows companies to receive early payment on their outstanding invoices. A company using accounts receivable financing commits some, or all, of its outstanding invoices to a funder for early payment, in return for a fee. What are the three primary types of receivables finance?

How does increase in accounts payable relate to financing activities?

Increase in accounts payable is added to net income in the operating activities section to convert accrual based net income to net cash provided by operating activities. The retirement of bonds is a financing activity and reported as cash outflow in financing activities section.

How is increase in accounts receivable reported in statement of cash flows?

It is reported as inflow of cash in financing activities section of statement of cash flows. Increase in accounts receivable is deducted from net income in operating activities section. Purchase of equipment by issuing a note is a non-cash investing activity.