How do I file my business taxes on a multi-member LLC?

Multi-member LLCs are taxed as partnerships and do not file or pay taxes as the LLC. Instead, the profits and losses are the responsibility of each member; they will pay taxes on their share of the profits and losses by filling out Schedule E (Form 1040) and attaching it to their personal tax return.

How should a multi owner LLC be treated for federal tax purposes?

Multi-Owner LLCs Like one-member LLCs, co-owned LLCs do not pay taxes on business income; instead, the LLC owners each pay taxes on their share of the profits on their personal income tax returns (with Schedule E attached).

What is the best tax option for an LLC?

As a simple and effective tax structure, many multi-member LLCs will find the partnership tax status to be an ideal choice. However, if your company plans to seek funding from outside investors or other types of passive owners, you may want to consider being taxed as a corporation.

Can I change how my LLC is taxed?

The process of changing the tax status of an LLC to a corporation or S corporation is called an election. To elect Corporation status, the LLC must file IRS Form 8832 – Entity Classification Election. To elect S Corporation status, the LLC must file IRS Form 2553 – Election by a Small Business Corporation.

What is the difference between a single-member LLC and a multi-member LLC?

Single-member LLC Ownership – A Single-member LLC has one owner (member) who has full control over the company. Multi-member LLC Ownership – A Multi-member LLC has two or more owners (members) that share control of the company. The LLC is its own legal entity, separate from its owners.

How does a multi member LLC file taxes?

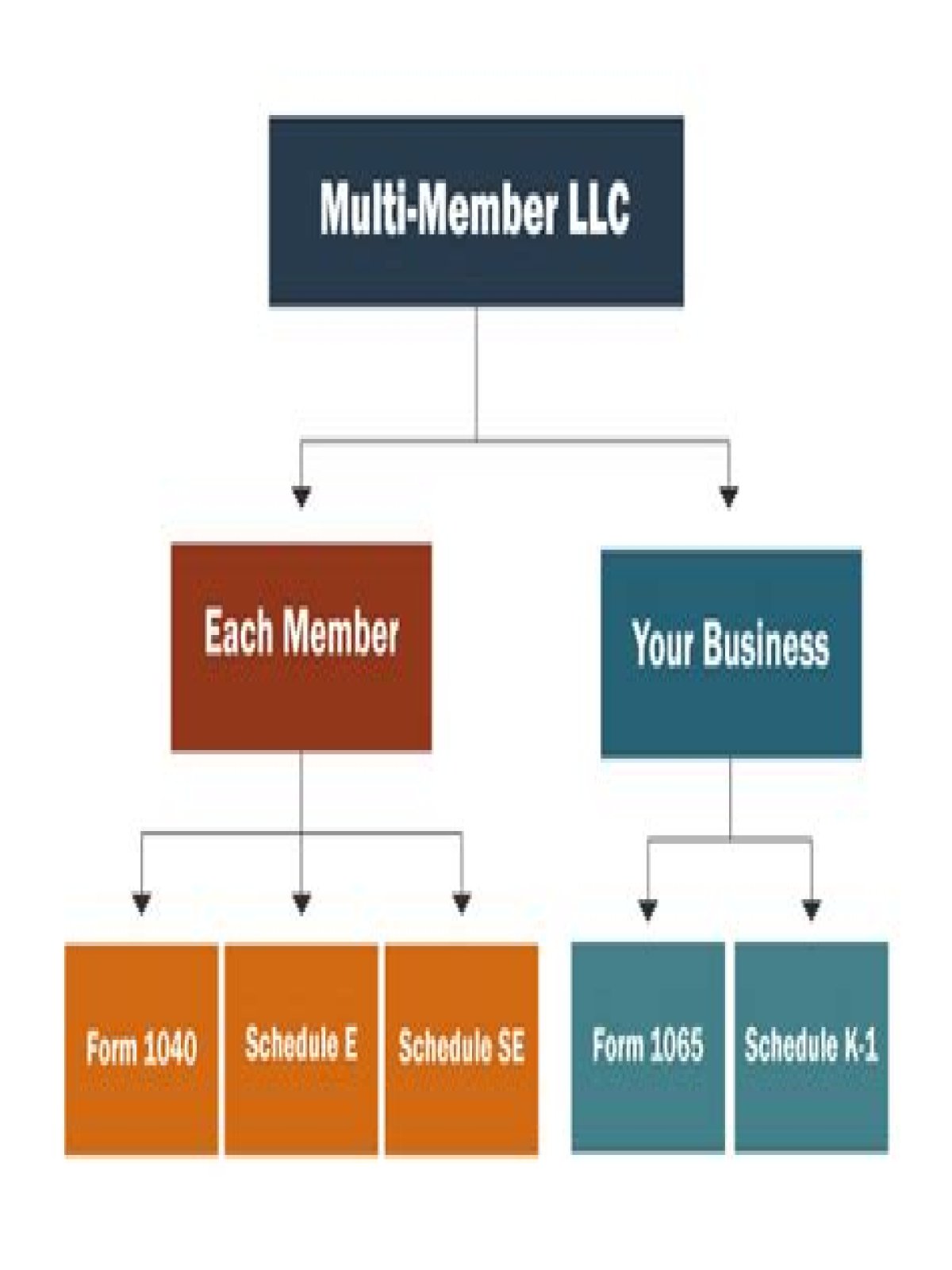

Filing taxes as a multi-member LLC The LLC files Form 1065 to report the business income or loss to the IRS, then gives each member of the LLC a Schedule K-1, which is used to report their share of the LLC’s income and deductions on their personal tax returns.

Can a multi-member LLC be a C Corp?

To elect C Corp tax status for your multi-member LLC, you must file Form 8832 (Entity Classification Election) when registering your business. Existing LLCs can also use Form 8832 to change their tax status to that of a C Corp. Your multi-member LLC has the option of S Corporation tax treatment, too.

What are the benefits of a multi member LLC?

Here are a few other benefits of starting a multi-member LLC: 1 There’s no limit to the number of members allowed. 2 Members can be individuals, LLCs, or corporations. 3 Members can be non-U.S. citizens. 4 The company doesn’t pay corporate tax. 5 Businesses can opt to be taxed as an S corp or C corp .

How are single member LLCs and sole proprietorships taxed?

Single-member LLCs are automatically taxed like sole proprietorships unless they request otherwise. Multi-member LLCs are automatically taxed like general partnerships unless they change their tax treatment. Unlike multi-member LLCs, single-member LLCs don’t need to fill out additional forms or a Schedule-K-1 at tax time.