How does an LLC work with multiple owners?

The multi-member LLC is a Limited Liability Company with more than one owner. It is a separate legal entity from its owners, but not a separate tax entity. A business with multiple owners operates as a general partnership, by default, unless registered with the state as an LLC or corporation.

Can you be a member of multiple LLCs?

It’s not actually unusual to have multiple LLCs, either as a sole owner or as one of a group of owners, or “members,” as they are called in an LLC. Owning more than one LLC may make sense if: Separate businesses. If you have two separate businesses, two LLCs can minimize your risk if one business fails.

Do all members of an LLC have equal ownership?

The ownership interest or equity in your LLC is called membership interest. For example, if you have four members who all have equal ownership in the LLC, then you would each have membership interest equal to 25 percent ownership. As a member of an LLC, you cannot freely transfer your ownership interest.

Can an LLC be owned by another LLC?

As for the legality of ownership, an LLC is allowed to be an owner of another LLC. LLC members can therefore be individuals or business entities such as corporations or other LLCs. It is also possible to form a single-member LLC whose only owner is another LLC.

Can LLC members be on payroll?

Generally, an LLC’s owners cannot be considered employees of their company nor can they receive compensation in the form of wages and salaries. To get paid by the business, LLC members take money out of their share of the company’s profits.

What does it mean to be multi member LLC?

Updated July 8, 2020: A multi member LLC is a limited liability corporation with multiple owners who share control of the company, and it stands in contrast with a single-member LLC, wherein one person is in sole control of the organization. History of Multi-Member LLC

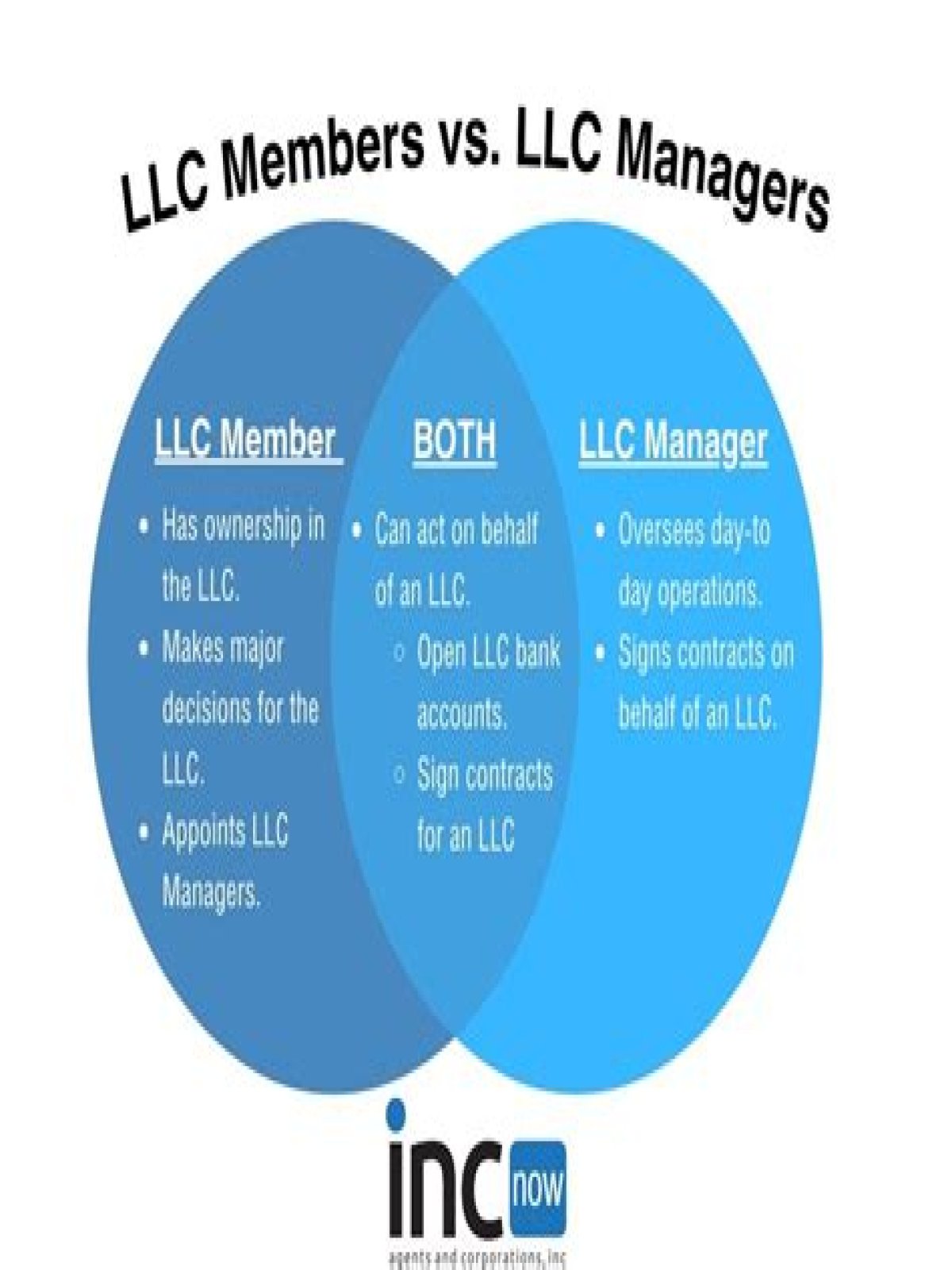

What does it mean to be a member of a LLC?

They’re also referred to as members of the LLC. An LLC is a limited liability company that has the advantage of being a pass-through entity and can change its status to that of a corporation for tax purposes. State laws generally allow the registration of LLCs with several members.

Can a LLC be owned by more than one person?

To create an LLC owned by many people, the intended owners of the LLC are required to file articles of organization with any state agency in charge of registering such business entities. The best option for people who are part of a small group planning to start a small company that will do business in one state is to start an LLC in that state.

Can a multi member LLC be taxed as a C Corp?

While this is their default tax classification, multi-member LLCs can request to be taxed as an S corp by filing Form 2553 or taxed as a C corp by filing Form 8832 . Multi-member LLCs are pass-through entities, which means the company itself doesn’t pay taxes.